Super Top-Up Health Insurance Plans

Enhance your Sum Insured at Low Cost!

Super Top-Up Health Insurance Plans

Enhance your Sum Insured at Low Cost!

WE ALL LOVE ICE CREAM!

Don't we?! Vanilla, Chocolate, Strawberry... pick your favourite flavour.

Now, to make it taste even better, we've got Sprinkles, Chocolate Chips, Caramel Drizzle... so many "Toppings" that make the treat a whole lot yummier and don't cost too much!

That's pretty much how Top-ups and Super Top-ups work. They make your Base Health Insurance Plan more enhanced. And they don't cost too much either.

Like Toppings on your Ice Cream!

What are Top-Up and Super Top-up Health Insurance Plans?

Top-up and Super Top-up Plans offer additional and extra medical cover with a host of benefits. They work pretty much like a regular or basic Health Insurance policy. Except for one main factor. And that is called a Deductible.

Now, this is important. . .

What exactly is a Deductible in Top-ups and Super Top-ups?

Deductible is basically a threshold amount predetermined by the Insurer in the Top-up or Super Top-up Plan, beyond which the Top-up or Super Top-up plan gets triggered. This means that all medical expenses up to this threshold amount or Deductible has to be borne by the policy holder. Once that threshold or Deductible is met or exhausted, balance medical expenses up to the Sum Insured in the Top-up or Super Top-up Plan will then be paid by the Insurer (as per plan specifics, of course).

Ok… Alright…

So what’s the difference between Top-ups and Super Top-ups?

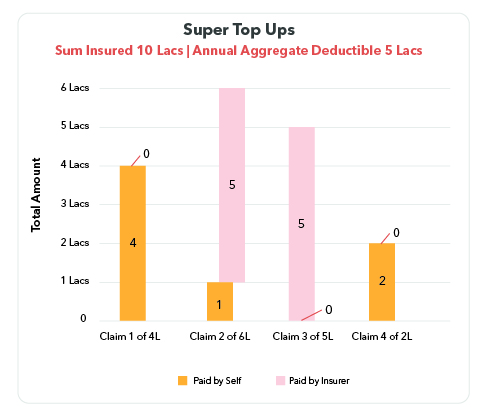

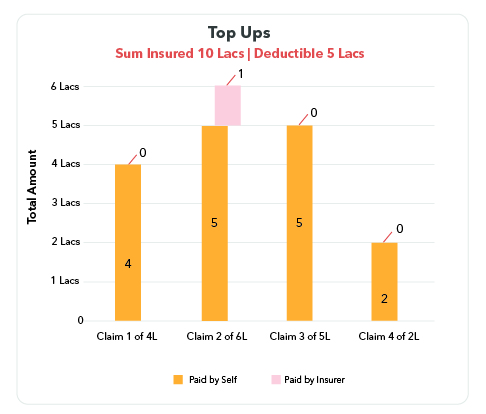

This concept of Deductible differs between Top-ups and Super Top-ups. You see, in Top-up Plans, Deductible is applicable on a single hospitalization or a per claim basis per year. This means that a Deductible in Top-up Plans is applied to each medical claim every time. So, in effect, each hospitalization bill has to exceed the Deductible threshold in a policy year. Whereas a Super Top-up plan covers all hospitalization bills once the Deductible is met. Here, it is called Annual Aggregate Deductible . So once the Deductible ceiling has been crossed, any amount of hospital bills can be claimed up to the Sum Insured amount of the Super Top-up Plan.

- * Claim 1: Amount Payable by Insurer is Nil because Annual Aggregate Deductible of 5 Lacs has not been met

- * Claim 2: Amount Payable by Insurer is 5 Lacs because the Annual Aggregate Deductible Amount of 5 Lacs has been met, and Insurer has to pay the differential of Total Claim Amount (Claim No.1 of 4 Lacs plus Claim No. 2 of 6 Lacs = 10 Lacs, minus 5 Lacs Annual Aggregate Deductible = 5 Lacs Claim Amount Payable by Insurer)

- * Claim 3: Amount Payable by Insurer is 5 Lacs because Sum Insured available is 5 Lacs (10 Lacs original Sum Insured amount minus 5 Lacs Claim Amount Paid by Insurer before)

- * Claim 4: Amount Payable by Insurer is Nil because Total Claim Amount Paid by Insurer before is 10 Lacs (5 Lacs plus 5 Lacs), and 10 Lacs Sum Insured of Super Top-up policy has been fully exhausted

- * Claim 1: Amount Payable by Insurer is Nil because Deductible of 5 Lacs has not been met

- * Claim 2: Amount Payable by Insurer is 1 Lac because Deductible of 5 Lacs has been met, and Insurer has to pay the differential (Claim No.2 of 6 Lacs minus 5 Lacs Deductible = 1 Lac Claim Amount Payable by Insurer)

- * Claim 3: Amount Payable by Insurer is Nil because Deductible of 5 Lacs has been met and it equals the Claim Amount (5 Lacs Claim No. 3 minus 5 Lacs Deductible - Nil Claim Amount Payable by Insurer)

- * Claim 4: Amount Payable by Insurer is Nil because Deductible of 5 Lacs has not been met

Got it!

So does this mean I need a Base Health Insurance Plan to buy a Super Top-up?

Well, technically you don’t. Meaning there’s no hard rule that you have to have a Base Plan before you buy a Super Top-up. But practically it makes more sense. Because of this Deductible factor. If you anyway have to bear the medical expenses up to the Deductible threshold, isn’t it better to have a Base Health Insurance Plan that does that for you? So, the smart thing to do would be to have a Base Plan with Sum Insured up to the Deductible specified by the Super Top-up Plan. That way, all medical expenses up to the Deductible will be met by your Base Plan, and anything above that will be paid by your Super Top-up Plan.

Is it better to go for Super Top-up plus Base Plan, or Base Plan plus another Base Plan?

Super Top-up Plans are comparatively cheaper with lower premiums than Base Health Insurance Plans because of this concept of Deductible. If you already have a Base Health Insurance Policy, it would be more economical to opt for a Super Top-up Plan that provides you with the kind of coverage you are looking for; both amount and conditions / treatments-wise.

More Bang for your Buck, you see!

Good Feature

Good Feature Average Feature

Average Feature Below Average

Below Average Not Applicable

Not Applicable