Critical Illness Insurance

An Essential Protection Against Life-threatening Diseases

How're you doing today? Fit and fine, we hope!

But, who knows what's going to happen tomorrow....? Life is so full of uncertainty!

"Don't worry, be happy!" is easier said than done...

To live your best life; stress-free, stay worry-less and smile more

Buy a Critical Illness Insurance Policy Cover Online today!Critical Illnesses are those diseases which are not only life threatening but can completely derail your financial situation. Critical illnesses like Cancer, Heart Attack, Kidney Failure are quite common these days.

The best part about Critical Illness Policy is that it doesn’t discriminate. Anyone can apply. Also, when you or your loved one is going through something so grave and serious, the earning capacity reduces instantly. It's quite natural to happen, and this does bring about a financial crisis in the family. And it can play havoc with your frame of mind and earning capacity. Which is why, Critical Illness insurance policy is necessary

Jab critical illness kisi ko bhi ho sakti hai toh critical illness insurance policy bhi koi bhi le sakta hai! Full democracy, you know!

Think millennials are invincible?

Think again!

Do us youngsters need Critical Illness insurance...?!

“Millennials” are smart and way more savvy than "Boomers". But they aren't the most disciplined or very healthy (Yeah, guilty!)

Which is why it's important to look at the other side - the wiser side of life. With our lifestyle and the world we live in, you and I are more prone to such illnesses. Hence the need for a Critical Illness policy is now more than ever!

IllnessA life-threatening ailment causes a serious impact on both work and savings. Regular earnings are affected as one is not able to attend the workplace regularly. Critical Illness insurance really comes in handy here.

Buying the best Critical Illness insurance policy helps you with a lump sum amount upon diagnosis of covered diseases. Thus, the treatment gets sorted and it doesn't eat into your hard-earned savings.

Fast paced life of 21st Century

has added enough stress in all our lives!

Not only do we need to alter our lifestyle, exercise more and eat better, we also need to cover ourselves financially. A Critical Illness policy is a perfect financial plan for all of us and a wise decision.

Now for some Important Facts. . .

Various features of a Critical Illness plan

- Got you covered! -The coverage is provided for all major grave diseases, depending on insurer and plan

- Lumpsum payment - You get a lump sum claim for the treatment and a part of it can act as a replacement of income

- Hassle-free – If you have the reports, your claim is settled after the survival period

- Coverage – It begins the moment waiting period ends!

- Salary Day - Such serious complications affect your income. So, a part of lumpsum payment can be treated as income, that too non-taxable! Pretty cool!

Now for some Important Questions. . .

What sort of diseases are covered in a Critical Illness policy?

Those are….

Now you know what's covered

Let’s look at what is NOT covered in a Critical Illness policy

- 30 days! Who knew 30 days would be so crucial?! Diseases in initial waiting period are not covered.

- If the person dies within 30 days of diagnosis or surgery, i.e. survival period.

- If critical illness develops due to alcohol, tobacco, smoking or drug intake.

- External congenital disorder leading to critical illness.

- Pregnancy or childbirth-related critical condition.

- HIV/AIDS

- Getting affected or going through trauma due to terrorism, wars, or military operations won’t be covered. While these are tough situations, they are viewed as critical illness

- Cosmetic Surgery or Dental Care (beauty does come at a price)

- Infertility treatment/ treatment to assist reproduction (but we’ll wait for the good news )

- Hormone replacement treatment

- Treatment outside India

Let's recap these benefits one more time

Benefit No.1:

Good news for those who have a family history

Destiny and family go hand-in-hand

Tell me. . .

Can you choose your family or genetics? Nope! Many critical illnesses are genetic, i.e. they run in the family. So, if your family has a history of grave ailments, it makes sense for you to explore a critical illness plan for yourself.

Benefit No.2:

The Bread Winner

#Facepalm on the term ‘Bread Winner! But we all crave carbs, don’t we? Okay, that joke stank, I know! But seriously, though, if you are the main earning member of the family, then you have an important role to play. If something happens to you, then your family will face the brunt of financial dip.

Hence, Critical Illness insurance policy cover

Benefit No.3:

Stress Buster!

No matter how much we love our jobs, we can’t take the stress away. Various studies show that people working in high-pressure work environments are at high risk of developing a dire condition over time.

Job stress?. . . Get Critical Illness cover today !

Benefit No.4:

Life begins at 40, but you've got to be more careful

Adulting is hard when you enter 40's. I feel your pain! The stress can lead to to life-threatening concerns in the long run. So, better to buy a Critical illness insurance policy by your mid 30's. When you do need the coverage later on in life, you won’t have to wait too long

Last but not least - Tax with good news!

Health coverage and financial benefit.. That's a double whammy!

According to the Income Tax Act, 1961 the policyholder can avail tax benefits. The policyholder can avail tax exclusion of Rs. 25,000 under Section 80D of the Income Tax Act, 1961. If you are paying premium for your parents and they are below age of 60, you can avail additional benefit of up to Rs. 25,000 . If your parents are senior citizens paying themselves, they can avail tax benefits up to Rs. 50,000 under the same section.

So that's pretty much it!

Now let's compare a normal Health Insurance plan and a Critical Illness plan

Normal Health Insurance Cover

|Critical Illness Cover

What's the need?

Medical expenses and hospitalization related expenses.

Pays lump-sum benefit on diagnosis

When does the cover start?

On hospitalization (minimum 24 hours)

On diagnosis of covered critical illnesses and exhaustion of "survival period"

Benefits

All billed expenses at the hospital are paid

Full Sum Insured on diagnosis

Where and how can the money paid by insurer be used

Insurer pays directly to the hospital against the bills or makes a reimbursement for expenses already paid by the insured

No restrictions!

Premium amount

Higher, because this provides a comprehensive cover against all kinds of illnesses and diseases

Lesser, because here only selected conditions (critical illnesses) are covered

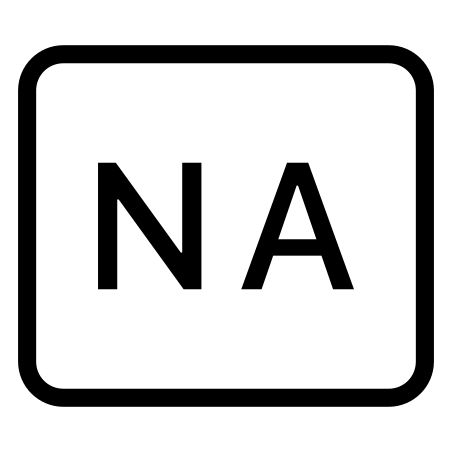

“Survival Period” Clause

Not Applicable

Payment is only made after the expiry of the "Survival Period"

Policy expiry

This policy can continue for lifetime. You can pay your premiums every year and keep renewing the policy and avail its benefits

Once the claim is paid, the policy ends

Good Feature

Good Feature Average Feature

Average Feature Below Average

Below Average Not Applicable

Not Applicable