Senior Citizens Health Insurance

For Best Assistance to Cope with All Your Unexpected Medical Difficulties

Health Insurance for Senior Citizens

As they say, "We are as young as our heart".

To keep up that vigour and vitality, we've got to take care of our health.

And to protect our health, we've got to get a good medical insurance plan!

With age comes experience. Some positive, some not so much. But each one teaches us a lesson.

Age does carry some harsh realities too. . . fragile health, physical and mental ailments... As age grows so does the cost of treatment.

Hence, Health Insurance for Senior Citizens is an important and a responsible decision. Many insurers in India (such as HDFC Ergo (erstwhile Apollo Munich), Max Bupa (now Niva Bupa), SBI, Star Health, TATA AIG, and others) have plans which specifically cover people who are at an age above 60 years (some schemes ever cover age above 70 years when applying). These plans provide critical illness cover, day-care expenses, cashless hospitalization, pre-existing disease cover and higher Sum Assured options.

- Hospitalization Expenses Cover: If you get hospitalized due to any illness for more than 24 hours, then the plan will cover room charges, doctor fees, nursing fees and basic expenses like medicines.

- Day-care costs: some conditions require less than 24-hour treatment. For e.g. Cataract, Dialysis, Chemotherapy etc. Such treatments are also covered.

- Ambulance charges: Nearly all senior citizen health insurance covers this.

- Existing diseases: Treatments arising out of some ongoing ailments are covered, but some conditions may apply.

Now for some important info!

Features of Senior Citizens Health Insurance Policy in India

Network Hospitals of choice nearby

Please make sure that your preferred hospital or clinic for treatment is part of the insurers network.

Day-Care facility

Many policies specify minimum 24-hour hospitalization to make a claim. They don't cover day-care expenses. Having to pay out-of-pocket for those might be tough at this age. Make sure you choose plans that cover sufficient day-care procedures.

No-Claim Benefit

Most insurers offer No Claim Bonus. If you don't make any claim for the full year the Sum Insured increases in the following year. Make sure you choose a perfect balance of Premium, Sum Insured and No Claim Bonus.

Pre- & Post-Hospitalization Charges

So in-patient hospitalization expenses are anyway covered. But there are also expenses you incur before and after. Like medical tests, procedures, pathology sampling etc. Those cost quite a bit, and should be covered too.

Free medical check-ups

Most insurers these days offer free annual health check-ups. That's necessary in old age as it updates you about your health conditions. Plus, it gives early warning signals if something is amiss, in case something is wrong. So having a plan that gives free medical tests would be a good idea.

Fast process. Easy claims

Claim Settlement Ratio and Turnaround Time are two wheels of the policy bicycle. If one goes out of order, the cycle stops. If the Claim Settlement Ratio of chosen insurer is high and Turnaround Time is low, that's a reliable insurer.

Premium Cost

Senior Citizen plans tend to be expensive as incident rates of hospitalization are high. So is the cost of the treatment. Look very carefully while choosing the right plan. Compare features like waiting period, pre-existing diseases, day-care and premium to make a prudent choice that suits you best.

Now on to . . .

Senior Citizen Health Insurance Tax Benefits

Elderly folk deserve all the benefits they can get. A good Senior Citizen Insurance Plan has good tax benefits.

As per Income Tax Act, 1962 Section 80D, if you have a senior citizen

mediclaim policy (age above 60 years), then you can save tax up to Rs.50,000. You can also add additional benefit of Rs. 5,000 towards preventive health check-ups in your medical insurance scheme.

So what do senior citizen health policies offer? A young mind and healthy body!

That's pretty much it!

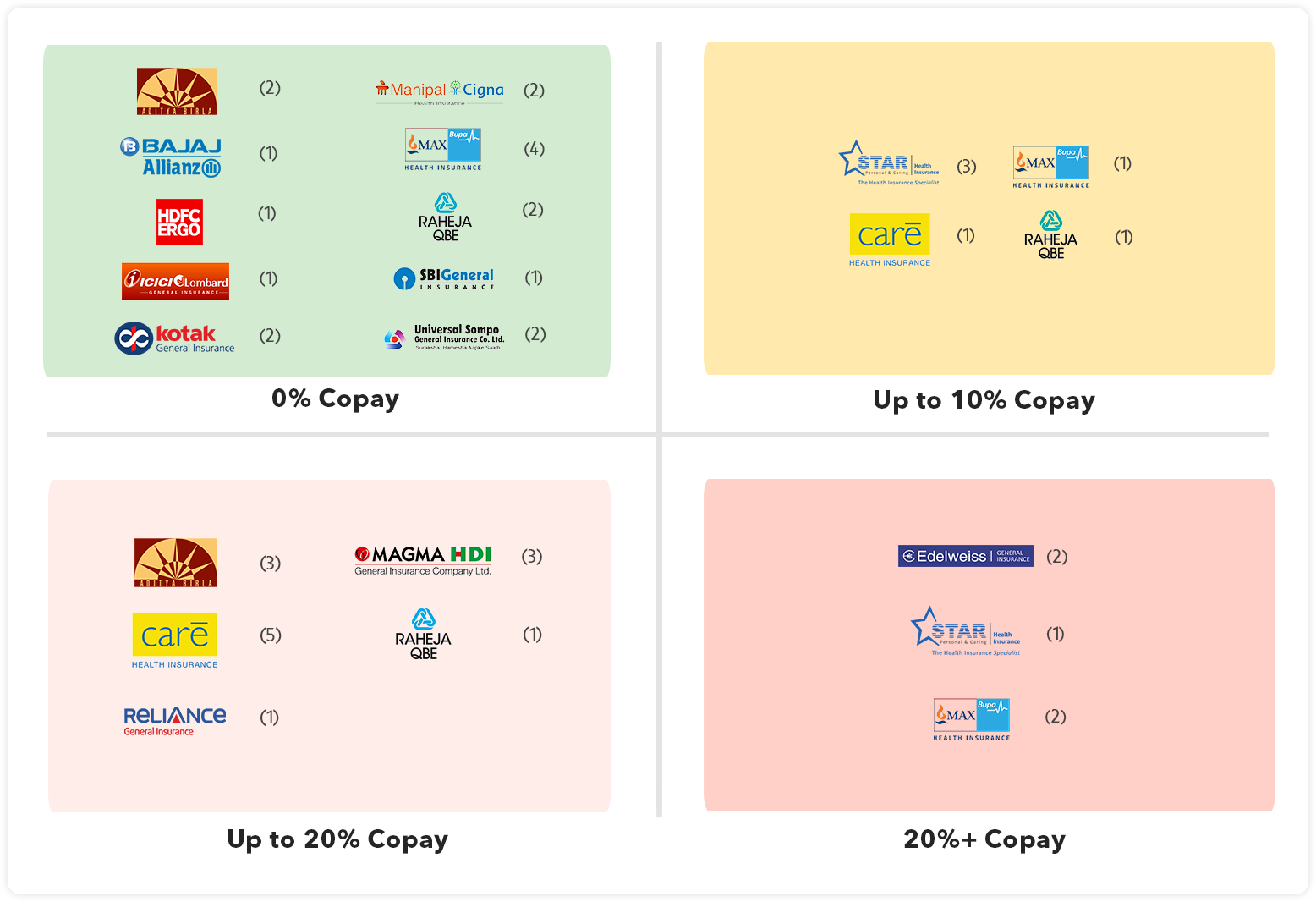

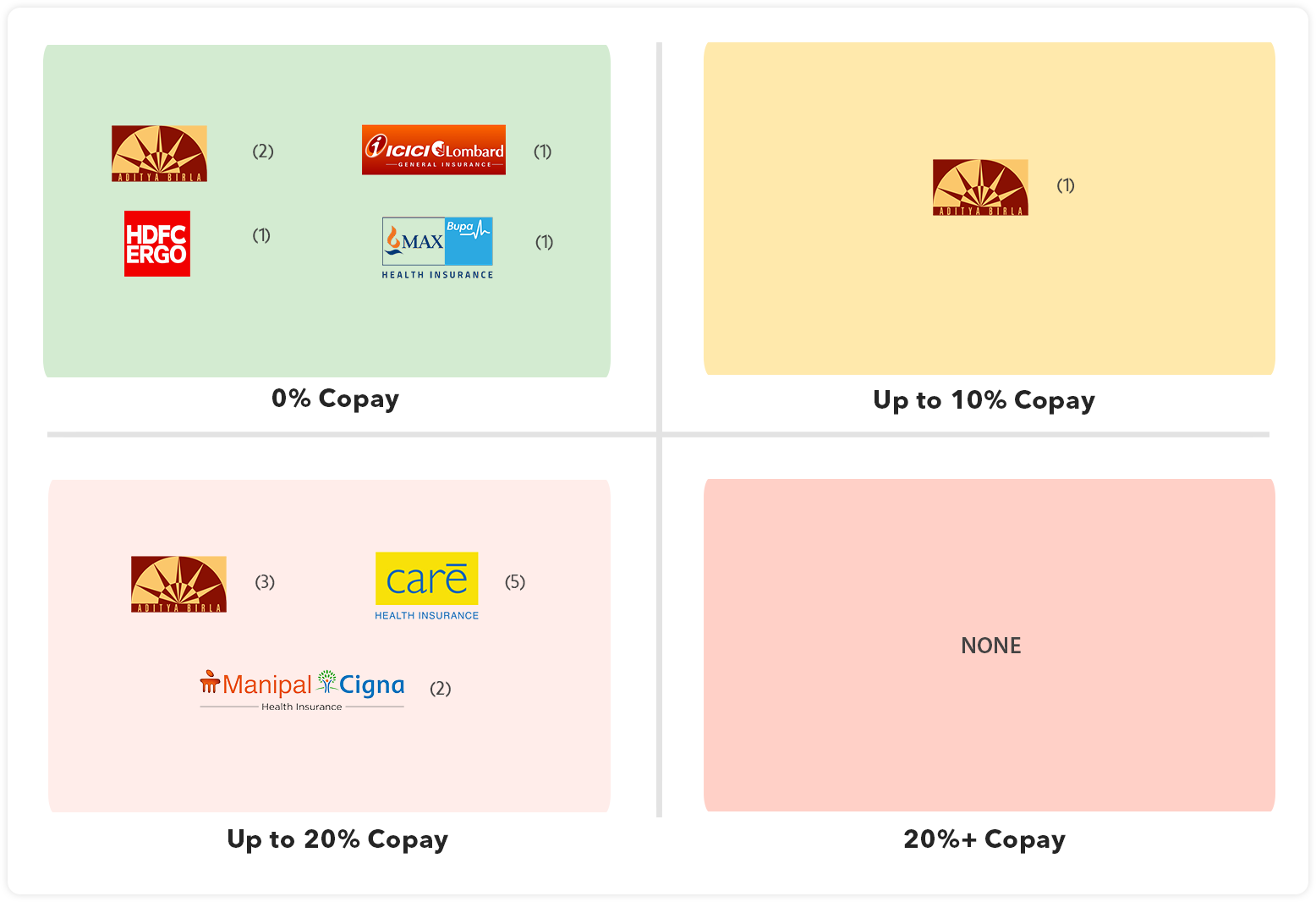

Good Feature

Good Feature Average Feature

Average Feature Below Average

Below Average Not Applicable

Not Applicable